It will become more expensive to buy your little piece of heaven this year, as lower-than-ever inventory in the City of the Angels continues to be the big story at the beginning of 2016. And with the lack of inventory in Los Angeles comes the inevitable rise in prices. All-cash offers and bidding wars are still the rule in every sought-after neighborhood and price range, especially if properties are correctly priced.

It will become more expensive to buy your little piece of heaven this year, as lower-than-ever inventory in the City of the Angels continues to be the big story at the beginning of 2016. And with the lack of inventory in Los Angeles comes the inevitable rise in prices. All-cash offers and bidding wars are still the rule in every sought-after neighborhood and price range, especially if properties are correctly priced.

“L.A.’s housing market, despite becoming more expensive and unaffordable, is not in a bubble,” UCLA economist William Yu wrote. “The current rise in home prices seems to be driven by rising effective demand and limited supply, not by speculation. Therefore, the housing bubble burst we experienced several years ago is unlikely to haunt us this year or next, and the smart money will continue to invest here.”

Check out more Location Scouts reports on housing-market conditions across the U.S.

Moreover, the forecast states that Los Angeles is in the middle of its rebound and can be expected to experience price increases for at least another four years, with values increasing 35%. Obviously the global economy and the current uncertainty about the U.S. elections could play havoc with the predictions, but on the whole, relative to other parts of the country and world, L.A. looks like a pretty darn good investment.

Ed Fitz Market Watch,com

A report from Harvard University recommends the college admissions process should place more emphasis on factors such as good citizenship and contribution to family and deemphasize things like the SAT exam and academic overachievement. Harvard’s Richard Weissbourd explains.

A report from Harvard University recommends the college admissions process should place more emphasis on factors such as good citizenship and contribution to family and deemphasize things like the SAT exam and academic overachievement. Harvard’s Richard Weissbourd explains.

WSJ.com Jan 29 2016

A gauge of pending home sales rose 0.2% in October, following two months of declines. Buyers are struggling with lean inventory that’s driving prices higher, said the National Association of Realtors. Its index of contract signings edged up to 107.7 and stood 3.9% higher compared to a year ago. The index has notched yearly gains for 14 straight months. NAR’s chief economist, Lawrence Yun, said supply isn’t keeping up with strong demand. “Unless sizeable supply gains occur for new and existing homes, prices and rents will continue to exceed wages into next year and hamstring a large pool of potential buyers trying to buy a home,” he said. The pending home sales index tracks real estate transactions in which a contract has been signed but the transaction has not yet closed.

A gauge of pending home sales rose 0.2% in October, following two months of declines. Buyers are struggling with lean inventory that’s driving prices higher, said the National Association of Realtors. Its index of contract signings edged up to 107.7 and stood 3.9% higher compared to a year ago. The index has notched yearly gains for 14 straight months. NAR’s chief economist, Lawrence Yun, said supply isn’t keeping up with strong demand. “Unless sizeable supply gains occur for new and existing homes, prices and rents will continue to exceed wages into next year and hamstring a large pool of potential buyers trying to buy a home,” he said. The pending home sales index tracks real estate transactions in which a contract has been signed but the transaction has not yet closed.

After seven years of being under intensive care, Fed chief Janet Yellen doesn’t believe the U.S. economy is ready to leave the hospital just yet.

After seven years of being under intensive care, Fed chief Janet Yellen doesn’t believe the U.S. economy is ready to leave the hospital just yet.

That’s why Yellen and her colleagues at the Federal Reserve decided last week to keep its benchmark rates at near 0%.

They might be right. The economy is hardly going gangbusters and there are real threats from China’s slowdown.

But some feel the Fed is coddling the economy by giving it more care than it needs. They argue emergency-level rates and Fed indecision are actually hurting confidence among consumers, investors and CEOs.

That’s why they believe a rate hike could actually boost the American recovery by reassuring the public, encouraging borrowing at cheap levels and generating some income for struggling savers.

“One particularly sad irony in all of this is that the Fed’s inaction may run entirely contrary to its own goals,” David Kelly, chief global strategist at JPMorgan Funds, wrote in a note to clients.

“By holding rates low, I believe the Fed is continuing to suppress economic growth and demand,” he said.

CNNMoney

Most single people own assets in their names individually and may also own some assets as a joint tenant with right of survivorship. Other assets, such as life insurance or retirement assets, will be distributed at death according to the terms of their beneficiary designations.

Most single people own assets in their names individually and may also own some assets as a joint tenant with right of survivorship. Other assets, such as life insurance or retirement assets, will be distributed at death according to the terms of their beneficiary designations.

How these varying assets are titled and how the beneficiary designations are prepared will directly impact who will get control of the assets and how they’ll be distributed at the individual’s death.

If an individual dies without a will (known as intestate), possessions are distributed according to the default laws of his or her state. Under these state laws, a married individual’s assets typically go to their spouse or children. For a single person, however, the default under state law usually provides that assets are passed on to their closest relatives (e.g. children, parents, siblings). If there are no relatives alive, assets may go to the state.

To avoid having the state decide the fate of your assets, it is imperative that you put an estate plan to ensure your wishes are carried out:

NextAvenue.org

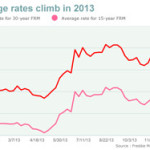

Economists have been declaring for years that mortgage rates were going to rise. Now those predictions seem to be coming true.

Economists have been declaring for years that mortgage rates were going to rise. Now those predictions seem to be coming true.

As the Federal Reserve contemplates raising its benchmark federal funds rate, home loans are becoming more expensive. Indications are that the days of the 30-year fixed-rate home loan at a rate below 4 percent are gone, if not for good, certainly for a long time.

For the third week in a row, the 30-year fixed-rate average remained above the 4 percent mark, according to the latest data released Thursday by Freddie Mac. It rose to 4.02 percent with an average 0.7 point this week. (Points are fees paid to a lender equal to 1 percent of the loan amount.) The 30-year fixed rate was 4 percent a week ago and 4.14 percent a year ago.

Although rates are rising, they remain near their all-time lows. The 30-year fixed-rate average hasn’t been above 5 percent since February 2011, and it hasn’t topped 6 percent since November 2008.

The 15-year fixed-rate average dropped to 3.21 percent with an average 0.6 point. It was 3.23 percent a week ago and 3.22 percent a year ago.

Hybrid adjustable rate mortgages also fell. The five-year ARM average edged down to 2.98 percent with an average 0.4 point. It was 3 percent a week ago and 2.98 percent a year ago.

The one-year ARM average slipped to 2.5 percent with an average 0.3 point. It was 2.53 percent a week ago.

“Economic releases confirmed increasing strength in housing,” Len Kiefer, Freddie Mac deputy chief economist, said in a statement.

By Kathy Orton at www.washingtonpost.com

WASHINGTON—A forward-looking gauge of U.S. home purchases rose for the third straight month in March, a sign of firming demand in the housing market.

WASHINGTON—A forward-looking gauge of U.S. home purchases rose for the third straight month in March, a sign of firming demand in the housing market.

The National Association of Realtors said Wednesday its pending home sales index, which is based on contract signings for purchases of previously owned homes, increased 1.1% to a seasonally adjusted level of 108.6 in March from an upwardly revised reading of 107.4 in February.

Economists surveyed by The Wall Street Journal had expected pending home sales would rise 1% in March. Home sales typically close within a couple months after signing.

The index rose 11.1% in March from a year earlier.

Lawrence Yun, NAR’s chief economist, said the jump in sales from a year earlier is good news, but “the increased number of traditional buyers who appear to be replacing investors paying in cash is even better news.”

By Kate Davidson at www.WSJ.com

The U.S. economy is looking a little tired. It’s losing momentum in puzzling ways. Hiring is still strong, but experts are starting to scale back their growth forecasts.

The U.S. economy is looking a little tired. It’s losing momentum in puzzling ways. Hiring is still strong, but experts are starting to scale back their growth forecasts.

Federal Reserve chair Janet Yellen summed it up well in a speech Friday: “If underlying conditions had truly returned to normal, the economy should be booming.”

Economists say there are two main problems: Workers’ wages aren’t growing much, if at all. As a result, Americans aren’t going out and spending much. On top of that, many foreign economies are slowing down, which puts pressure on the U.S.

The question going forward is whether we’re just in a blip or a bigger shift is taking place.

“The consumer really hasn’t kicked in at full speed ahead,” says Peter Cardillo, chief market economist at Rockwell Global Capital. “We’re going through a soft patch.”

With March’s jobs report out on Friday, this economic head-scratcher will be in full focus this week.

Related: Good news: Unemployment at lowest in 7 years

Still strong on jobs: The U.S. added over half a millions jobs in the first two months of this year alone. That’s a 50% increase from the same two-month stretch a year ago when the Polar Vortex had much of America in a funk.

Job gains have come across the board: health care, construction, the service sector and retail businesses have all seen strong pick up. The unemployment rate is down to 5.5%, its lowest mark in seven years.

It would be a full-steam story on jobs except for one thing: wage growth.

Hourly wages only grew 2% in February. That’s a marginal bump up, but it’s too little for most Americans to notice the recovery’s progress. It’s also well below the Federal Reserve’s roughly 3.5% goal.

SAN JOSE — The Silicon Valley economy may be booming, but its self-professed capital, the city of San Jose, is hardly paving the streets with gold. The home of eBay, Cisco and Adobe can’t keep libraries open full time, plug most potholes or staff a police force that can investigate many burglaries.

SAN JOSE — The Silicon Valley economy may be booming, but its self-professed capital, the city of San Jose, is hardly paving the streets with gold. The home of eBay, Cisco and Adobe can’t keep libraries open full time, plug most potholes or staff a police force that can investigate many burglaries.

While much of the focus of San Jose’s dreary budget picture has centered on rising pension costs, a deeper problem remains: San Jose pulls in less money in taxes per resident than other big U.S. cities and even its suburban neighbors because it simply doesn’t have enough shops and businesses to support its sprawling population.

By Nike Rosenberg at Mercury News

As Fannie Mae sees it, 2015 will be a good year for the housing market, even if residential real estate has to get dragged into the black.

As Fannie Mae sees it, 2015 will be a good year for the housing market, even if residential real estate has to get dragged into the black.

Fannie Mae’s 2015 Economic Outlook, released Thursday, is less a picture of a purely positive housing market than an expectation of an economy so strong across several key growth sectors that it will propel the national housing market to greater heights than in 2014. Or, as Fannie Mae puts it, the economy is strong enough to drag housing behind it and create growth by default.

“Our theme for the year, ‘Economy Drags Housing Upward,’ implies that both housing and the economy will pick up some speed in 2015, but that the economy will grow at a faster pace,” said Doug Duncan, chief economist at Fannie Mae.

Fannie Mae expects strengthening private domestic demand to drive the economy up 3.1 percent in 2015—up from the agency’s earlier prediction for 2.7 percent growth.

While that prediction is still modest, Fannie Mae says it’s strong enough to “drag last year’s unspectacular housing activity upward,” according to the report. Fannie Mae credits projections for continued low gasoline prices, firming labor market conditions, rising household net worth, improving consumer and business confidence, and reduced fiscal headwinds to usher in a year of steady, if “not yet robust” economic improvement that should lead to a higher rate of household formation in 2015.

“Consumer spending should continue to strengthen due in large part to lower gas prices, giving further support to auto sales and manufacturing,” Duncan said. “We believe this will motivate the Federal Reserve to begin measures to normalize monetary policy in the third quarter of this year, continuing at a cautiously steady pace into 2016 and 2017.”

Duncan also said he suspects mortgage interest rates to stay low throughout this period, attracting steady supply of new homebuyers.

Fannie Mae’s report echoes the sentiments of the National Association of Home Builders, which also this week spoke of bluer housing and economic skies ahead. Top economists and housing experts in a panel at the group’s International Builders’ Show in Las Vegas predicted a recovering labor market, low interest rates, and improvements in credit availability for borrowers as the three main triggers for growth in the housing market this year.

These assessments, however, are not shared by everyone, at least not blanketly. Earlier this month, Trulia’s chief economist Jed Kolko warned that falling oil process could have a recessive effect on housing in major oil-producing state such as Texas, Oklahoma, and Louisiana.

Kolko did say, however, that lower fuel prices could just as likely stimulate flagging industrial economies in the north and Midwest, where oil production is virtually nonexistent.

Regardless, Duncan and Fannie Mae foresee big things, even if this year will not be a breakout year for housing. “We expect the rising share of new home sales to lead to a healthy increase in single-family construction of about 19 percent, or 765,000 units,” he said.

Scott Morgan from DSNews

![]() It will become more expensive to buy your little piece of heaven this year, as lower-than-ever inventory in the City of the Angels continues to be the big story at the beginning of 2016. And with the lack of inventory in Los Angeles comes the inevitable rise in prices. All-cash offers and bidding wars are still the rule in every sought-after neighborhood and price range, especially if properties are correctly priced.

It will become more expensive to buy your little piece of heaven this year, as lower-than-ever inventory in the City of the Angels continues to be the big story at the beginning of 2016. And with the lack of inventory in Los Angeles comes the inevitable rise in prices. All-cash offers and bidding wars are still the rule in every sought-after neighborhood and price range, especially if properties are correctly priced.